Following increased tariffs on the U.S.'s trading partners, many manufacturers have seen increased difficulties obtaining raw materials and other supplies, shipping finished goods, and covering shipping costs. Nearly half of all manufacturers surveyed stated that they have experienced disruptions in their supply chains, forcing them to seek out new suppliers—often with difficulty. Despite this, the aerospace manufacturing industry is seeing a lot of growth.

Part of the reason for this growth is a number of large mergers and acquisitions. While the current U.S. administration's policies have been tough on a number of industries, $718B of the 2020 defense budget has been allocated to the Pentagon, or nearly 5% more than the previous year. This gives the Pentagon more money for paying contractors, and an added impetus for aerospace companies to build their portfolios and present a more enticing package. This has encouraged a number of high-dollar mergers, adding to a growing number that have formed since 2017.

The consolidation credited with beginning the wave of mergers was Northrup Grumman's acquisition of Orbital ATK. It was followed by General Dynamics acquiring CSRA Inc., with 2017 culminating in United Technologies Corporation's $30B acquisition of Rockwell Collins. This trend continues through 2019—United Technologies Corporation recently agreed to merge its aerospace businesses with Raytheon to form a new entity valued at about $166B.

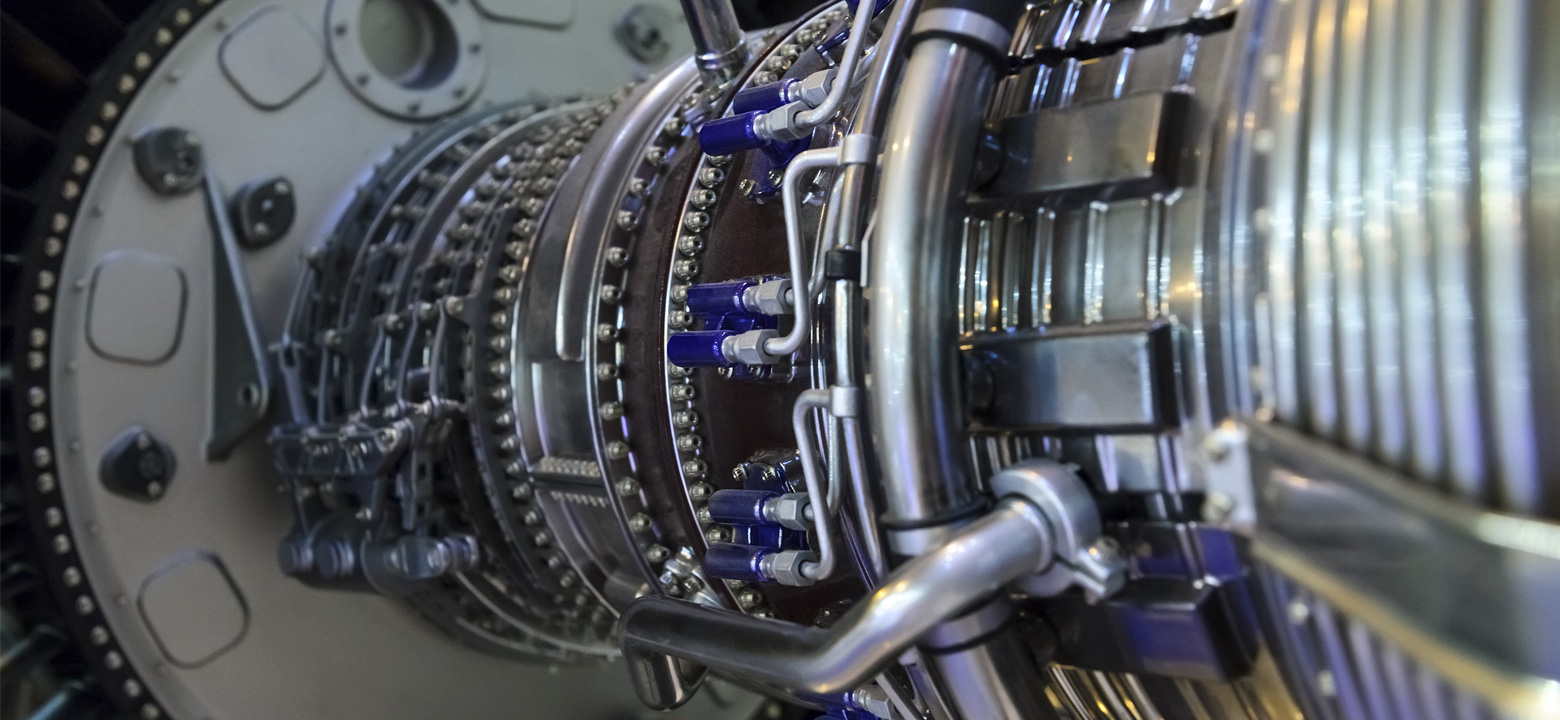

2018 was a very good year for suppliers within the U.S. About 65% saw increased demand over the previous year, while about half of surveyed manufacturers increased their number of staff to keep up. Many parts for the aerospace industry are made and shipped domestically. Wesco Aircraft Holdings offers a variety of parts needed by aerospace manufacturers, including bearings, tools, and assorted hardware. As of this writing, they anticipate a 12% growth in year-over-year earnings, in addition to a nearly 9% growth in revenue. GKN Aerospace in Tallassee, Alabama, is just one of the state's producers of parts for the aerospace industry, and one of the key players benefiting from the state's initiatives to increase Alabama's presence as an exporter. According to figures from Alabama's Department of Commerce, the state's aerospace manufacturers made $2.4B in shipments to 97 countries, for a 28% percent growth over the previous year. This represents a growth of about $1B over 2016's numbers. As long as U.S. aerospace parts manufacturers can continue production without experiencing more interruptions in their supply chains, things should continue growing smoothly.

Even niche markets within the aerospace manufacturing sector are experiencing smooth growth. As the ability to produce lightweight parts and materials improves, there has been increased demand for supplies like aerospace foam—a key component in the manufacture of both small and large aircraft. As developing economies around the world develop the ability to sustain low-cost regional airlines, the market for aerospace foam has expanded. Following current projections, 2028 should see a global aerospace foam market valued at approximately $11B.

Interestingly, tariff and supply chain concerns are only part of the picture when it comes to keeping up with the growing demand for aerospace parts. The number one challenge facing any manufacturer continues to be finding and retaining skilled staff—with previous generations' emphasis on college education and white collar jobs, there remains a dearth of laborers willing and able to go into manufacturing. Even now, according to the National Association of Manufacturers and the Manufacturing Institute, only about 30% of parents would encourage their children to pursue a manufacturing career. With so many U.S. manufacturers trying to expand their labor force, experts predict that a potentially severe talent shortage may be in the future. According to a report by the Society of Human Resource Management, over 25% of current manufacturing workers are looking at retirement within the next decade. Many companies are offering retirees incentives to keep working on a part-time or work-from-home basis, partnering with vocational schools, and developing other ways to retain and expand their labor force, but it may take some time for this to pay off.

Finding competent producers for parts is a challenge, and that goes double for technologically advanced industries like aerospace. It seems that, despite U.S. manufacturers' trouble with sourcing raw materials and increased cost due to tariffs, aerospace companies around the globe are still willing to pay a premium for U.S.-produced parts and supplies. When you couple this with increased government spending and several key mergers, it's easy to see why the aerospace industry continues to experience significant growth. As long as U.S. producers are able to maintain their supply chains and expand their talent pools, this growth should continue.